|

|

Inspired by this classic WSB post. Signature ($110B AUM, boom) might have been more appropriate than CS. |

A

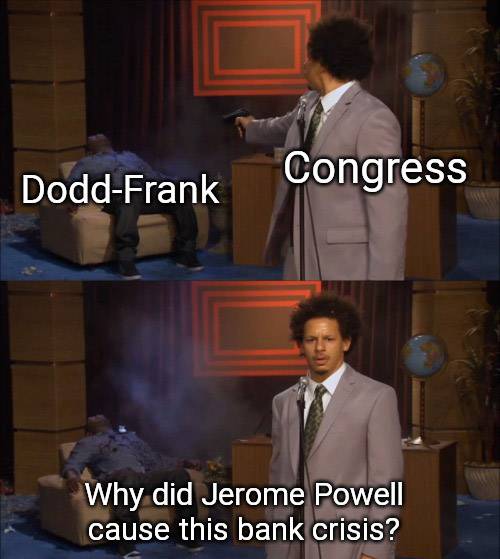

quick addendum to yesterday's finpost, there was this meme on WSB:

A meme???

Anyway, is Congress to blame?

|

|

|

/u/awesomedan24

As a wild oversimplification: Dodd Frank was legislation that regulated the financial sector to prevent another 2008 crisis. Banks didn't like it because it reduced their ability to YOLO the economy. Banks heavily lobbied Congress in 2018 and got themselves an exemption from the act. Now banks have been YOLOing and losing big as a result.

|

|

|

|

|

/u/throwaway761212

Link.

No laws matter if we don't punish the bankers that pick and choose which ones to follow.

|

"No laws matter if we don't punish the bankers that pick and choose which ones to follow." While we laugh at miniscule fines for SEC violations,

personal accountability isn't a necessary condition for effective regulatory enforcement. Just look at how organizations respond to civil liability risks.

That said,

holding individuals to account was certainly help the cause. More on that later.

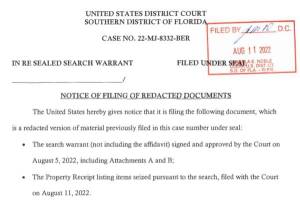

I clicked through to the Brookings article from May 2018.

Brookings in 2018: Dodd-Frank is nbd

Brookings

Brookings |

No, Dodd-Frank was neither repealed nor gutted. Here's what really happened

False narratives:

1. The bill repeals and replaced Dodd Frank.

|

I don't recall the discussion at the time. Were the words 'repeal' and 'gutted' thrown around in normal conversation or only by fringe pundits and grandstanding congressmen? If it's the latter, I already dislike the article's partisan tone. Oh, hey, "false narratives", cool.

Brookings

Brookings |

2. This law 'guts' Dodd-Frank.

The major change cited in this argument is the increase of the so-called 'Bank SIFI' threshold, which increases the size at which a bank is subject to enhanced regulation by the Federal Reserve. Dodd-Frank set this line at $50 billion, unindexed for inflation or economic growth. The law raises this figure to $250 billion.

|

I agree, though I'm not sure if I'm agreeing with the author's takedown of a strawman ("Dodd-Frank has been gutted!").

Stress tests and reserve requirements are trivially the most important for megabanks, so cutting regional banks out of those regulatory requirements is less an evisceration and more of a dismemberment or half-castration. It's far from safe though. Dodd-Frank was Congress's solution to 2008, a saga that demonstrated two things:

- Contagion.

- The willingness to find creative workarounds to regulations, from Wall Street to NINJA lenders.

Wikipedia

Wikipedia |

Lehman had morphed into a real estate hedge fund disguised as an investment bank. By 2008, Lehman had assets of $680 billion supported by only $22.5 billion of firm capital.

|

Lehman isn't a great comparison to SVB or Credit Suisse, but there is a common theme:

banks need to have an adult in the room. Let's read some more Brookings:

Brookings

Brookings |

3. Major new lending is coming to individuals and small businesses.

This is the argument put forth by many in Congress and within the banking industry. As the Independent Community Bankers Association argues: "The new law will spur greater consumer access to credit and business lending in Main Street communities nationwide." There is no direct provision in this law that accomplishes this and the argument that reduced regulatory costs for a subset of banks will translate into more lending as opposed to greater profits is just speculation.

|

This was a really weird claim to make. It looks bad in retrospect, but also retrospect right now isn't substantially different from restrospect post-2008. The author says that it's pure speculation that banks will chase assets rather than business efficiency. I guess in his mind the burden of proof is on whomever he is addressing. But while he's not necessarily making an affirmative argument, it's worth noting that

claiming banks would choose business efficiency over assets is pure speculation.

Brookings

Brookings |

4. This law fulfills President's Trump promise to 'do a big number' on Dodd-Frank.

A bill signing ceremony is a natural moment for a President to say he has delivered on a campaign promise. The lack of major legislative achievements for President Trump and the Republican Congress only compound the pressure to argue that this bill does more than it actually does.

Trump may still deliver on his promise, not by legislation, but by the actions of financial regulators he appoints. Appointing his top budget staffer, Mick Mulvaney, as Acting Director of the Consumer Financial Protection Bureau, has resulted in a series of major rollbacks and revisions of key rules and regulations to protect consumers and prevent many of the abuses that were at the heart of the financial crisis. If the CFPB is the cop on the beat patrolling against unscrupulous lending, Mulvaney, as the new chief of police is ordering the force to take a nap.

|

No disagreement here, it's the ol' trick of

making regulations seem superfluous by not enforcing them.

Unrelatedly, I'm now dreading the 2024 election cycle when we'll again hear things like, "I'm going to do a big number on Dodd-Frank".

The invisible hand

|

/u/king-kong-schlong

It was bad oversight and risk management. Blaming it on one thing isn't a serious analysis.

The deregulation didn't really make sense or help but it's still managements job.

|

|

|

/u/shoeless_sean

Allowing the business and finance world to self regulate is like putting a shotgun in your mouth and your finger on the trigger during an earthquake and blaming the earthquake when your brain repaints the wall

|

|

|

/u/El_Gonzalito

Whilst I respect your name, the comment I do not. Dodd Frank forced good oversight and risk management as minimum standards along with capital requirements, etc. Deregulation once again meant we just trust the management of the institutions to do the right thing.

|

|

|

|

/u/king-kong-schlong

While I totally agree with you about oversight and regulation and the 2018 rollbacks were clearly misguided and a mistake. None of the stress testing and almost certainly not the LCR requirement would have caught the SVB meltdown. This probably highlighted a hole that even full Dodd frank might not have stopped

|

"None of the stress testing and almost certainly not the LCR requirement would have caught the SVB meltdown." My understanding is that SVB's long term issue was interest rates but their immediate problem was liquidity. With the variety of liquidity backstops available to banks, I don't think it's trivial for an outsider to determine

how close SVB was to stopping the bank run snowball. But say SVB could not have been saved by Dodd-Frank, there are many more regional banks now exposed to these failures that would be better off with mandatory cash reserves and stress test compliance. Dodd-Frank was not written to save a single bank, it was written to prevent

a total meltdown.

I'm hoping this all blows over uneventfully, but if there was little risk of contagion I doubt Yellen and Powell would have stepped in so swiftly and so authoritatively.

There does seem to be a consensus above that SVB failed at risk management. Well, the institution of SVB failed at risk management,

the individuals responsible for the decisions might well have come away with maximal personal gain. A few datapoints that are far from comprehensive:

Glass-Steagall

Much of the other discussion was about Glass-Steagall, the depression-era law that partitioned higher risk investment banks from commercial banks. It was repealed in 1999 but

perhaps could be of use in the modern age of cryptocurrencies and the (eyeroll) 0DTE craze.

Some posts from this site with similar content.

(and some select mainstream web). I haven't personally looked at them or checked them for quality, decency, or sanity. None of these links are promoted, sponsored, or affiliated with this site. For more information, see

.